Welcoming a baby boy to my family (pause for applause) has left my September rather busy, and I couldn’t face anything too meaty and intelligent and subtle in my viewing: I wanted some simple fare that would be both entertaining and familiar. I was, therefore, delighted to see that September was a month of ‘threequels’. I am a big fan of both My Big Fat Greek Wedding and The Equalizer; they are uncomplicated and inviting, funny and charming, doing what they do (romantic comedy/culture-clash/action/man-against-the-world) efficiently and good-naturedly…

Their third instalments fail spectacularly.

My Big Fat Greek Wedding 3 is neither charming nor funny, and it hardly has any wedding in it. The first instalment was a delightful example of a classic American movie trope: culture clash between the first and second generation immigrant communities that make up the country. Tula Portokalos falls in love with a handsome WASP, while her family want her to marry a nice Greek boy. As they prepare to marry, Nick (the fiancé) has to assimilate to the Greek way of living (and really rather likes it) and Tula comes to learn to be far more accepting of her heritage and her family. Part two is less funny and less engaging – a convoluted plot about the mother and father of Tula never being truly married, and having a later-life wedding – but revisits the old favourite characters, and introduces a daughter to take up the ‘growing-pains-culture-clash’ dynamic (Tula repeating her father’s iconic line in a nice way).

My Big Fat 3k Wedding has now divested itself of all humour and winsomeness. Gus (the patriarch) is dead, and his widow may have dementia. It was his dying wish that his children take his old diary and hand it over to his three childhood friends. Its Holiday on the Buses then. Its ‘we-have-run-out-of-ideas’ so let’s go abroad. It’s a travelogue rather than a rom-com, focused on giving you an lovely panoramic shot of provincial Greek living. That aspect of it is fairly spectacular: the cliffs, the sea, the distressed cottages with just the right amount of cracked plaster and whitewash…ah, 90 minutes of that would’ve been lovely. Instead, the truly great character of the Greek countryside is constantly sidelined by turgid dialogue and performances that are either flatter than a pita or a gurning mess better suited to children’s television. There is one good joke delivered in such a staccato as to miss the punchline, half of the original characters are absent, and the wedding comes out of nowhere and doesn’t have any impact.

The truly frustrating thing is that there seems to be no central theme, no thrust, no point. The first was a classic rom-com, with elements of culture clash and ugly duckling and mad families. The second was about aging and how parenting changes you. 3k Wedding has too many themes and none. A storyline about having a parent with dementia, ignored. A story about grief, barely given the time of day. A story about forbidden love and refugees and the migrant crisis, there only when convenient. A story about bucolic provinciality coping with a 21st century world, there only in snatches. The closest thing to a coherent theme is that of culture and soil and homeland having a pull and a power on even those who grew up across an ocean, and that is a genuinely interesting idea to explore…then a gurn and a non-joke and a shot of a goat…its rubbish.

1.5 stars.

The Equalizer 3

A travelogue at the start of the month and one at the end with The Equalizer 3. 3qualizer is a second reuniting of star Denzel Washington and director Antoine Fuqua, who made some cinematic magic with the first film. Denzel is Robert McCall, an expert government assassin who can kill you within 9 seconds, and that’s without a weapon in his hand. McCall starts the first film adrift, his wife has died and he is retired and now he has no direction or purpose. His spark of life is reignited when he meets a young prostitute, takes pity on her, and proceeds to kill every Russian mobster who has ever even looked at her.

It is glorious. McCall’s obsessive-compulsive precision is turned into a joyous conceit where he can say exactly how long it will take him to kill every person in the room. It is pacy, it is non-stop, with a simple yet effective plot and a mesmerising Denzel performance (when is he anything less!?). The second instalment is less effective, with a more meandering plot, but still good fun. McCall has decided he will find meaning in his later life by putting his skills to the service of the underdog. He is The Equalizer, cutting villains down to size and bringing justice to the lowly. He takes on a fatherly duty with a young man who is in danger of joining a gang, and he executes all the bad men who killed his oldest friend.

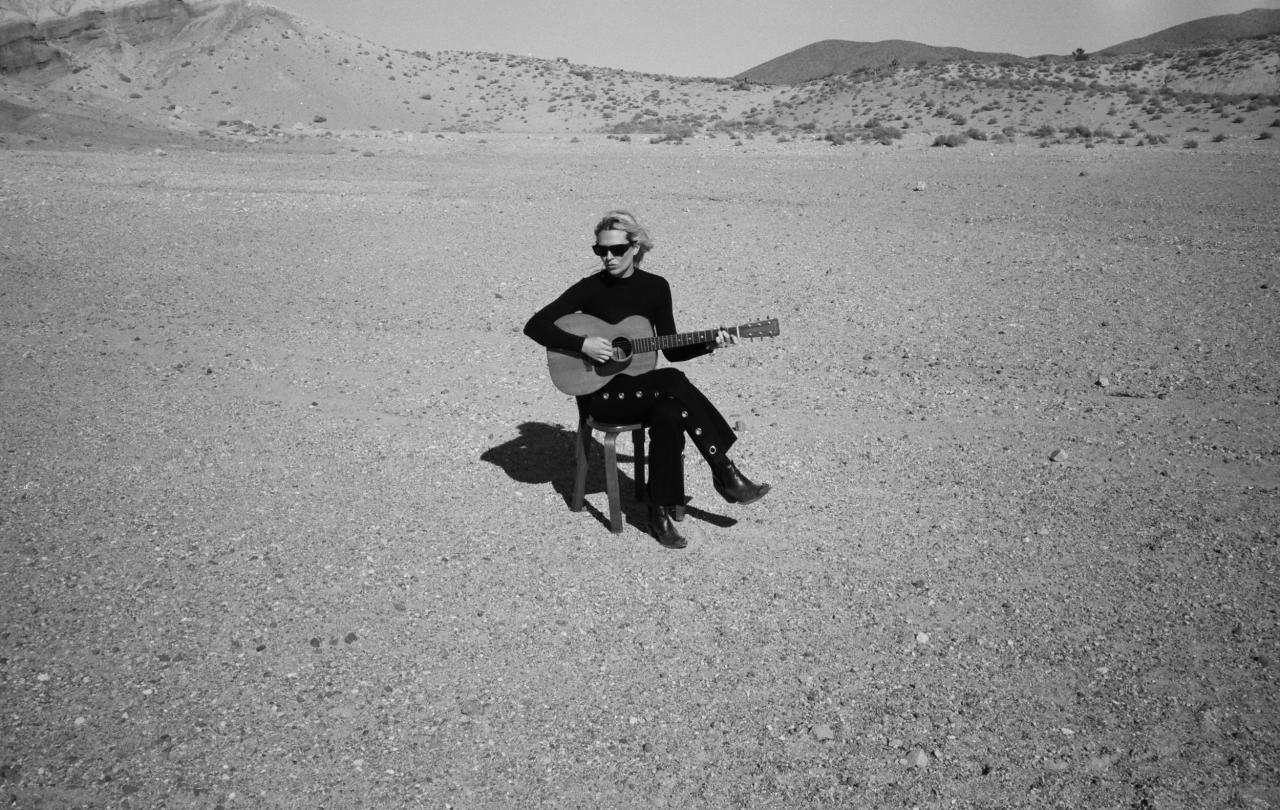

3qualizer is…in Italy. Why is it in Italy? No idea. Perhaps McCall has caused too much property damage in the US. McCall is sitting in a chair in a wine cellar in Sicily. A bad man walks in. He informs him how many seconds it would take and then dispatches the rotters. As he is leaving he is shot (in the buttocks?) by the young son of the chief baddy. He drives as far as the Amalfi Coast where he is saved by a local policeman and a local doctor. Then…he goes for walks. He enjoys Italian coffee. He meets the locals. He eats pasta. He becomes both dull and unbearably quirky at the same time.

There is no real plot. Mafiosi terrorise the town for no discernible reason. McCall kills them. More Mafiosi come. McCall kills them. Two…two action scenes after the wine cellar, that is all I counted. When the film ended I had to do a double take and wonder if I’d fallen asleep. I’m not suggesting the first two films were Barry Lyndon, but they had a plot with some twists and turns – 3qualizer has a whole lot of scenery. Like Greece, the Amalfi Coast looks gorgeous, but I didn’t pay my money to watch an extended message by the Italian tourist board.

There’s a side-story about a CIA agent cutting her teeth on the fallout of the Sicily shootout…why? Mysterious as McCall’s original presence there. Nothing makes any sense or connects and it's just as turgid as 3k Wedding, which is far worse a sin for an action movie to commit. So you know, both questions are answered at the end of the film and the answers relate to nothing, NOTHING we see in the main body of the film.

McCall’s story ends with him being embraced by the villagers and him embracing them…? I HAVE NO IDEA! It is unclear and sloppy, and (perhaps because of the boredom he must have felt while filming) Denzel Washington has turned McCall’s dangerous precision into a series of tics and twitches which are simply alarming.

1 star.

Two very disappointing cinematic outings which, despite being very different genres, make the same errors. Perhaps because they seem to be scrabbling to explore the same theme. What is home? What does it mean to be home and know you are home? What does it mean to be comfortable and accepted and know yourself as yourself in the place that you are? Tula seems to be trying to understand this and explore the entire concept of the ‘immigrant mindset’ by going to Greece to see her father’s village…I think this is what she is doing, again, the film makes it hard to understand its own themes. McCall is a man who has no home – his career was spent travelling (alienated from his home soil), his wife is dead (alienated from his family), and he is a man who has killed too many people (alienated from himself). Perhaps a small fishing village will give him the simplicity of life that can save his sense of self.

Both Tula and McCall start to unravel their existential crises by fleeing the big city, embracing quieter and humbler surroundings, and coming to understand the nature of community that is symbiotic and self-giving and joyous (something McCall has never had, and something Tula has struggled with in terms of her own family). In both, there is something of a monastic pattern. Coming away from distraction and metropolitan living and building a community of reciprocity in the wilderness, this is the aboriginal pattern of life for the monk and the nun – from St Anthony in Egypt to St Benedict in Italy, Christians in the East and West have benefited greatly from the prayers and example of holy men and women who live the ‘religious life’.

The great insights of monastic living – simpler living of work and rest in intentional community where one lives from the whole as much as for the self – are having a bit of a come-back in secular society. Whether it is the meditative practice of the Desert Fathers entering mindfulness manuals, or the Rule of St Benedict (ordering the life in community for a Benedictine monk) being used to train managers in major companies, the wisdom of monasticism has endured even into the 21st century post-Christian world. Tula and McCall find some peace in this wisdom; they don’t embrace the religious life, but they do find comfort and stillness and real joy in a life that slows its pace and opens itself up to a community of service and sacrifice and love. 3k Wedding might symbolise this with the presence of an actual monk in the film…doubtful, but one can hope.

This is an insight far better expressed by reading about monasticism. Do that, rather than watch these films. They’re rubbish.