For the first time, in a long time, I can honestly say that last Friday night, I gave it large. I was at a singalong show at the Cheltenham Playhouse, with hundreds of other people belting out the words to some well-known and well-loved songs.

As an actor-turned-vicar, I am one of life’s unusual people for whom singing is a normal and expected part of life. Yet still, I was taken by surprise by what a truly fabulous evening I had, singing gustily along with hundreds of people I didn’t know.

Seen & Unseen’s Belle Tindall wrote an article some time ago about the power of Jacob Collier’s concerts to make strangers feel a sense of belonging. I’ve not been to one, but I feel like I went to a lower brow version of that on Friday night.

I went to James B. Partridge’s Primary School Assembly Bangers Live Show. Which is almost certainly more mainstream and on trend than you think. He arrived on many of our radars when he took Glastonbury by storm last year, but he’s also performed at the Edinburgh Fringe 2024, Latitude, and The Big Feastival. He has been featured on BBC’s The One Show, and ITV’s Loose Women. He featured live on ITV News and on BBC Radio 1 and BBC Radio 2. His online videos have been written about in The Times, The Independent, Buzzfeed and featured in a number of podcasts. And now he’s even got a mention on Seen & Unseen…

For those of you who still have no idea what I’m talking about, let me take you back to Lockdown. Which may be triggering for some, and for that I apologise. Mr Partridge is a primary school music teacher and during Lockdown, he was trying to bring some joy into the lives of the children that he was still trying to teach online. And indeed, into the lives of their parents. He put some “Assembly Bangers” on YouTube, and the videos went viral; they just made people feel better by singing along. And so, it began.

Partridge is a great musician and all-round showman – he knew exactly how to play his audience – who were, by the way, really up for it. Some had even come prepared with fruit shakers and triangles to play. I kid you not. Although the bulk of his playlist were indeed Assembly Bangers, the nostalgic singalong extended beyond the Assembly Hall. He played a couple of bars of the intro and the entire theatre burst into the theme song of 90s Australian soap opera Home and Away. He delighted us with a medley of Alan Menkin’s Disney classics from The Little Mermaid through to Tangled. I even got involved in the SClub7 mash up. Get me.

Partridge told lots of great stories and anecdotes in between songs and one stuck in the mind. He’d recently received a message on Instagram from a woman who had had an accident in her early 20s and, because of brain damage, had lost all memory of her childhood. Until she listened to some of his Assembly Bangers. Through reconnecting with some of the songs she had sung at Primary School, memories attached to those songs started to come back. Amazing. Beautiful.

This is a widely known phenomenon. Music – and specifically singing – is increasingly becoming a feature of dementia care because, in trials, it has proved powerful in sparking memories, often long after other forms of communication have diminished.

There’s also research proving that singing releases endorphins – serotonin and dopamine – the ‘happy’ chemicals that boost your mood and make you feel good about yourself. Singing in the shower or with a hairbrush/microphone is, apparently, genuinely good for you.

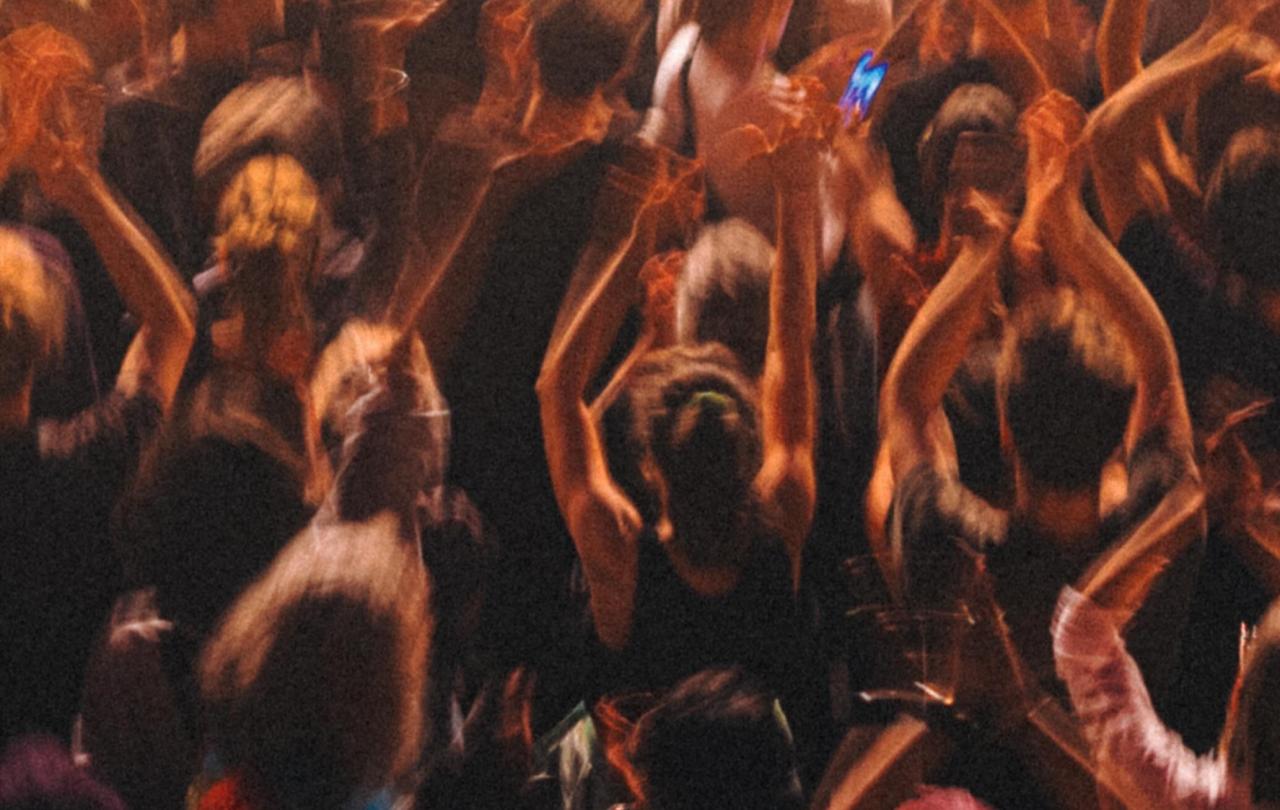

At the same time, we all know that, if you can get over your self-consciousness, singing is a fantastic communal activity. Just go to a football match or a karaoke bar to find the proof. And the good news is, it doesn’t matter whether you think you can sing in tune or not: apparently the health benefits will still be the same. Although possibly not for those standing next to you.

With all this in mind, it’s interesting to note that much of the greatest classical music ever written (for choirs and orchestras) was composed in worship of the Christian God. Handel, Mozart, Bach, Brahms, Hayden all churned out the bangers of their time. In the same tradition, John Newton, Charles Wesley, Matt Redmond, Chris Tomlin and Stuart Townend – all have written songs that have helped us, over many generations, to lift our eyes and our souls in song.

The saying, "the one who sings, prays twice," attributed to St. Augustine, helps us understand something about the spiritual power of singing and how it takes our words to the next level. There is something “more” happening when we sing; our whole being is connected, somehow; it’s physical, mental and spiritual all at once.

The Bible is full of songs and exhortations to God’s people to sing in praise of their God – because it’s good for us. As with so much cutting-edge psychological research, we are only catching up with what has been found in the Bible for thousands of years.

Sunday by Sunday in churches around the world, Christians sing songs. Songs that teach or remind us about who God is, songs that lift our souls and minds away from the cares and trials of our lives and the state of the world. Songs that take our eyes off ourselves and transport us into a place of worship. Songs that connect our memories of the past with God’s promises for the future. We sing to join together; we sing to join with the choir of Heaven and experience something of the Kingdom of God that we can all too easily miss otherwise. This is powerful stuff.

Singing along with James Partridge, the Assembly Bangers ranged from the obvious Morning has Broken and All Things Bright and Beautiful to songs steeped more deeply in Christian-ness, such as Give me Oil in my Lamp and Colours of Day (Open the door/let Jesus return[…] Tell the people of Jesus, let his love show).

For the big finale, Partridge took a vote, and the clear winner was Graham Kendrick’s beloved banger, Shine Jesus Shine. Funnily enough, the Sunday morning before this Friday night, I had thought of Graham Kendrick. As I pressed play on a CD player in a tiny medieval church in a tiny Cotswold village, I thought how Kendrick probably wouldn’t have anticipated Shine Jesus Shine to lift such ancient rafters. But he almost certainly wouldn’t have expected it to be sung by hundreds of theatre-going people who probably haven’t been anywhere near a church in years, if ever.

By the end of James B. Partridge’s Primary School Assembly Bangers Live Show, I have to say I felt brilliant. I had had a bad day and somehow the joy of singing had made me feel better. The joy of singing with other people and making a shared noise, singing words of prayer and praise as loudly and as freely as my lungs could support, just made me feel better. If you can get tickets, I heartily recommend catching the tail end of his sell out tour so you can experience it for yourself. It’s a bizarre event, a glorious mish mash of secular and sacred but one that the church can learn from and which I can’t help thinking makes God smile.

By way of Epilogue, as we all poured out of the theatre, and towards our cars, I heard a gaggle of strangers-become-friends skipping across the car park singing,

Flow, river, flow

Flood the nations with grace and mercy,

Send forth Your word,

Lord, and let there be light.

To which I say a happy and hearty Amen…

Celebrate our 2nd birthday

Since March 2023, our readers have enjoyed over 1,000 articles. All for free. This is made possible through the generosity of our amazing community of supporters.

If you’re enjoying Seen & Unseen, would you consider making a gift towards our work?

Do so by joining Behind The Seen. Alongside other benefits, you’ll receive an extra fortnightly email from me sharing my reading and reflections on the ideas that are shaping our times.

Graham Tomlin

Editor-in-Chief