If you are a football fan, you might be flabbergasted, curious and maybe a bit gleeful about the recent “dip” in form of Manchester City. It runs deeper for me; I’m an Arsenal fan.

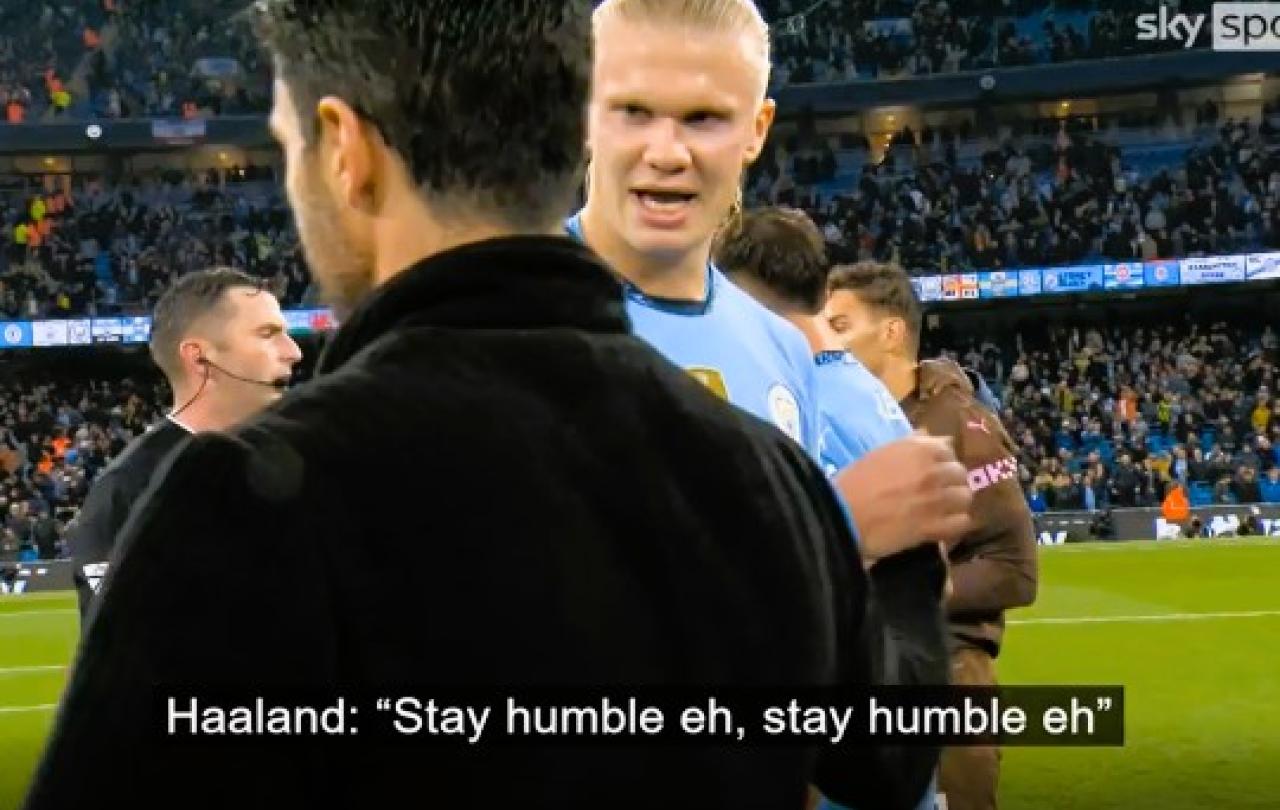

So let me address the elephant in the room before I go any further. Yes, we haven’t won the league for 20 years and yes, we’re everyone’s banter club, I get it. But Haaland’s “Stay humble” comment, directed at my team, was a lot for us and here’s my take on why.

I grew up in an African household. I have been taught to respect my elders. We aren’t allowed to be overly familiar with anyone older than us. You don’t randomly pat your elders on the back. There is a level of reverence that is not only expected but covertly and overtly demanded. Almost every child of African heritage has been chastised by a parent or caregiver with some version of “Is that your classmate?”, after taking things a bit too far with an aunty or uncle, aka anyone more than 10 years older than you.

So, you can imagine my shock like so many Arsenal fans when Haaland decided that he was going to tap our manager on the shoulder and utter the words, ’Stay humble.’

Football is a game of banter. I agree. Tottenham, Manchester United…. say no more, as we say in South London. My brother thinks I dislike Manchester United more than I support Arsenal. That could be truetrue, but I digress.

I would have completely understood if Haaland had done what he had done and said what he said to Saka, Gabriel or any other Arsenal player. But the manager, no, that’s taking the mick. The manager is off-limits he is supposed to be respected by the players.

That’s why Arsenal fans, were celebrating the way we did when the boys humbly beat Man City 5-1.

I know, it’s been a few weeks, now. I’m a Christian I am supposed to be over it. But I’m not.

The older I get the more I understand the wisdom of respecting those with more experience than me. Not just because it was what I was taught, but because I want my parents' generation to be respected. I want to be respected when I am older and I want my children’s generation to be respected, too.

We live in a moment in time where the differences between generations are often magnified. Intergenerational collaboration doesn’t exactly roll off the tongue and it isn’t something you hear every day. But I am reminded by my faith that there is wisdom in age and long life brings understanding. Strength and passion are found in young people. Communities work best when the young and the old work together in mutual respect.

If I want to live in a society that respects all generations, my role as a millennial (someone who sits awkwardly in the middle), is to ask myself two questions:

When I meet someone older than me, would I be happy if someone were to treat my mum or dad the way I am treating this person?

If they are younger than me, would I want someone to treat my siblings like this?

Join with us - Behind the Seen

Seen & Unseen is free for everyone and is made possible through the generosity of our amazing community of supporters.

If you’re enjoying Seen & Unseen, would you consider making a gift towards our work?

Alongside other benefits (book discounts etc.), you’ll receive an extra fortnightly email from me sharing what I’m reading and my reflections on the ideas that are shaping our times.

Graham Tomlin

Editor-in-Chief