“If you’re looking for a job, here’s something that I think will change your life”.

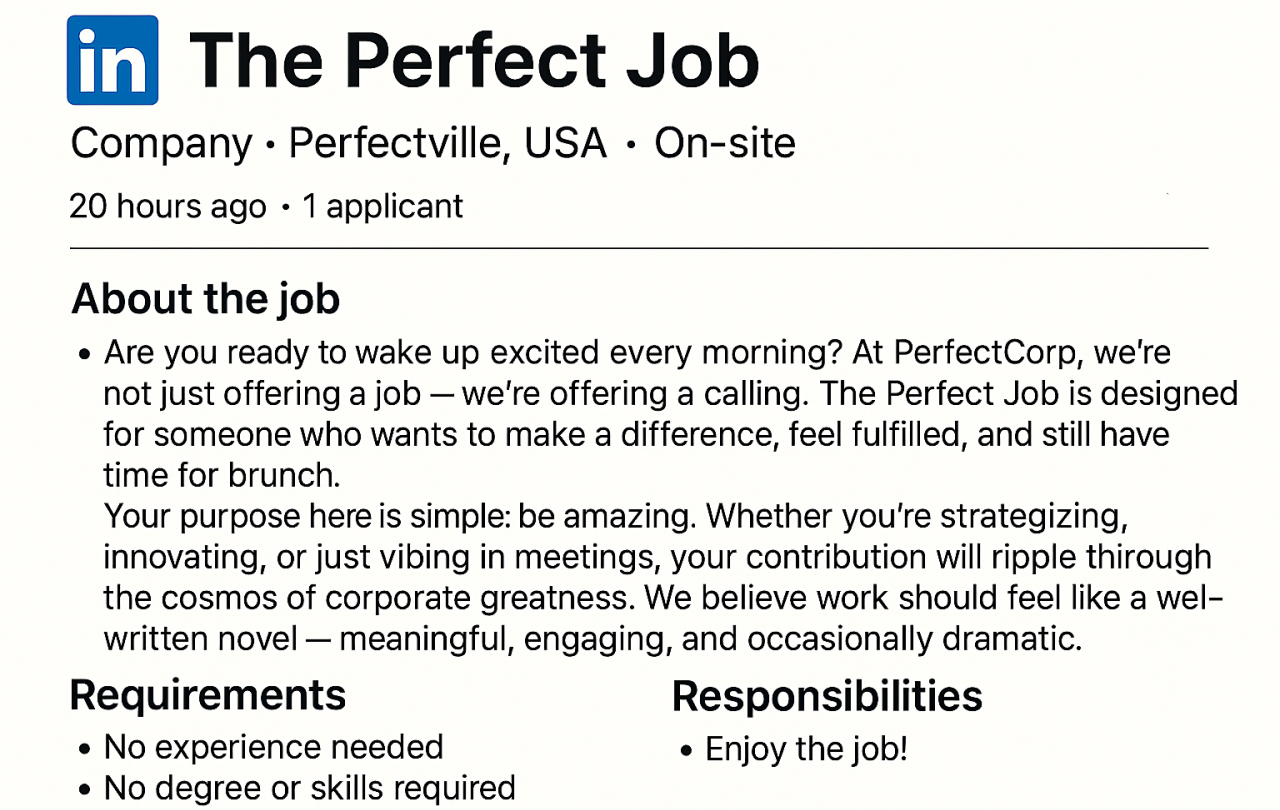

This is not the first time my social media has targeted me with an advert selling a better job, a higher paying role, a more fulfilling career, a more purposeful company. This is a new iteration of a long train of ‘Cinderella’ job advertisements I’ve received, promising that I will find the slipper if I just give away a bit more of my contentment and attention. If you’ve clicked on this article, I imagine you might be in the same boat.

The hustle influencers tell me that I could find a job with higher earnings and greater financial freedom. They say that I should be an entrepreneur, that working in a standard job is like existing as a subordinate in a dystopian novel. They ask me, “Why are you not a millionaire yet?” They can teach me if I just sign up to their free course.

The effective altruism influencers tell me that I need to find a job with purpose. I must change the world with every minute of my working day, or my work at best, isn’t worth doing, and, at worst, is actively harmful. I need to be an effective altruist, not just with my money, but with my vocation. They can teach me if I just attend their conference.

I’m sure there is plenty of good in both of these camps.

Entrepreneurship takes our creative human instincts and crafts them into endeavours that can drive economies, create jobs, and aid human flourishing. It releases actual potential in ways that 9-5 roles are often unable to do.

Purposeful work enables us to spend our 80,000 hours at work solving problems that matter. It can ignite our passion for work and facilitate the best minds focusing on the most complex issues.

However, as these career marketers point young people towards the professional promised land, they inadvertently create a malaise of discontent at work. Out of this, I frequently find myself questioning whether I’m doing the right job. When people ask me about my work, I’ll respond hesitantly, unable to hide this small sense of vocational shame I carry. I actually quite like my job. But no, I’m not an entrepreneur. And no, I haven’t found the most purposeful work I could find.

Every so often, this discontentment reaches boiling point, and I spend hours scrolling through LinkedIn, researching Masters, or thinking about small businesses I could start. Unsurprisingly, this compounds the discontentment as the Cinderella job I’m looking for remains tantalisingly elusive.

Social media has exacerbated this problem. Influencers trade on attention, and young people’s professional discontentment generates plenty of that commodity to trade in. Worse than that, it’s a market with easily generatable new leads – I’ve found that all it takes are a few 30-second videos about “the career you wish you had”. Surely this is part of the reason why “91% of millennials say they expect to change jobs every three years, and the average tenure for workers between the ages of 25 and 34 is 2.8 years”, according to Zippia, a careers site.

I sometimes need reminding that I just need to look; to look at the friendships I have with my colleagues; to look at the interesting problems I get to work on.

This discontentment is not a new feeling, and I’ve appreciated the following parable from the Jesuit priest Anthony De Mello as I’ve wrestled with discontentment about work. It’s called "The Little Fish."

"Excuse me," said an ocean fish. "You are older than I, so can you tell me where to find this thing they call the ocean?"

"The ocean," said the older fish, "is the thing you are in now."

"Oh, this? But this is water. What I'm seeking is the ocean," said the disappointed fish as he swam away to search elsewhere.

"Stop searching, little fish," says De Mello. “There isn't anything to look for. All you have to do is look."

Like the ocean fish, I sometimes need reminding that I just need to look; to look at the friendships I have with my colleagues; to look at the interesting problems I get to work on; to look at the privilege of having a job in the first place; to look at the beauty in the small things, like a good cup of tea to start the work day.

There are certainly times when searching for a career change is the right thing, but De Mello reminds me that in always searching for the next thing, I could easily miss ocean of opportunities right in front of me.

Support Seen & Unseen

Since Spring 2023, our readers have enjoyed over 1,500 articles. All for free.

This is made possible through the generosity of our amazing community of supporters.

If you enjoy Seen & Unseen, would you consider making a gift towards our work?

Do so by joining Behind The Seen. Alongside other benefits, you’ll receive an extra fortnightly email from me sharing my reading and reflections on the ideas that are shaping our times.

Graham Tomlin

Editor-in-Chief