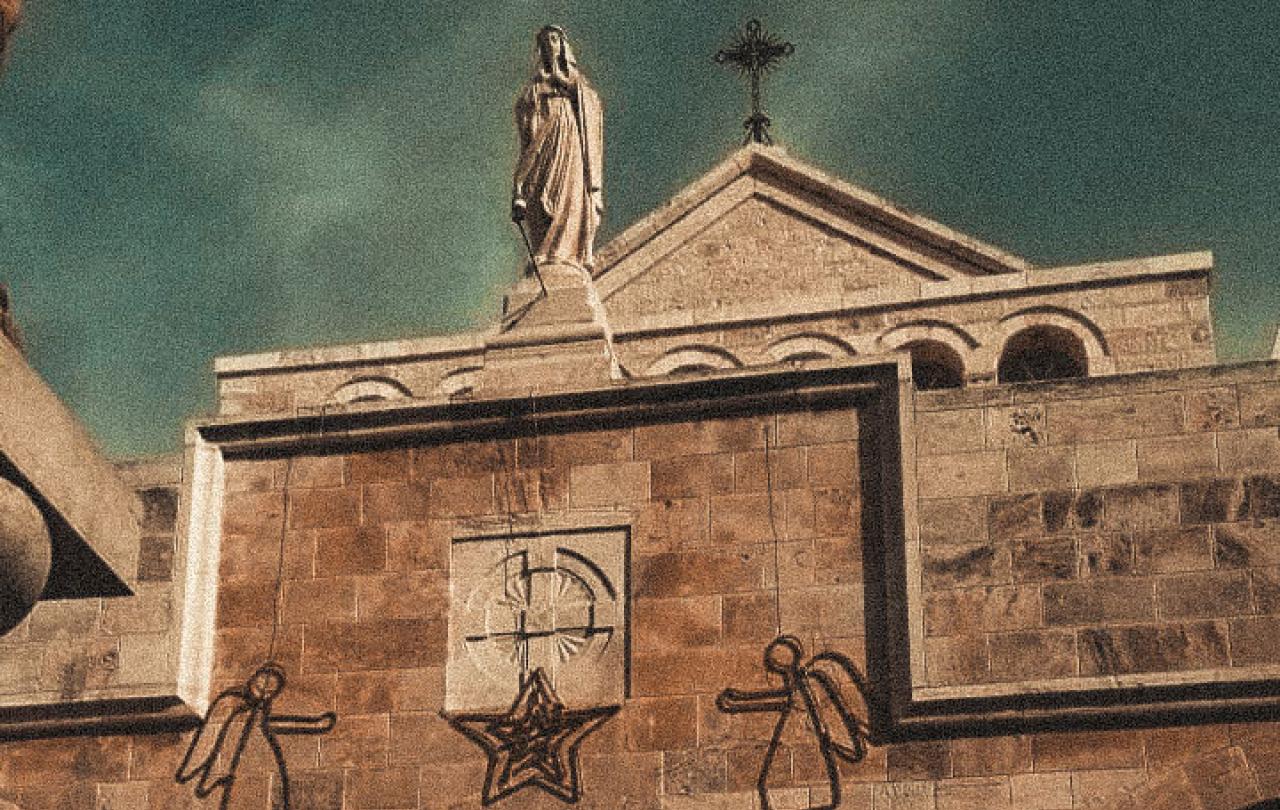

Religious minority groups, like Christians, represent about one per cent of the overall Palestinian population. We feel stuck between a rock and a hard place in this conflict. As a consequence of this war, many of us are already planning to emigrate once the opportunity arises. If this happens, Bethlehem will virtually become a non-Christian city. This would be a sad outcome given it was the birthplace of Jesus Christ and that in the early 1900s the Christian population used to be just under 85 per cent. Now Bethlehem's population is approximately five per cent Christian. After this war we fear that these statistics would decrease even more. The main source of income of the city heavily relies on tourism, with almost 70 per cent of Bethlehem’s GDP due to religious pilgrims from all over the world visiting Jesus Christ’s birthplace, especially during Christmas.

This is the first year for decades, when all Christmas festive displays have been cancelled in Bethlehem. This decision taken by Bethlehem municipality and the Palestinian church is a sobering and poignant one and comes with a financial heavy price paid by locals. Such traditions have been kept for decades, even during the second Intifada, so that between 2000 to 2005 a Christmas tree in Manager Square was still displayed each year. Even the Covid-19 pandemic did not stop Bethlehem from decorating the entire city. However, today many Palestinian Christians are not in a festive mood. The Israel-Hamas war is in its second month and has already a higher death toll than during the whole of five years of the second Intifada.

A ceasefire is what Palestinian Christians will be praying for during this Christmas, alongside praying against the perpetual cycles of death, violence, and destruction.

In my opinion it feels fitting to stand in solidarity with those who mourn, inspired by Paul’s letter to the Romans encouraging Christians to “Rejoice with those who rejoice; mourn with those who mourn”. During such devastating circumstances of the civilians in Gaza, Palestinian Christians are heartbroken at the enormity of lives lost and the desperate conditions experienced especially by children. The desire to celebrate the birth of the most important child in Christianity’s history is dimmed by the death toll of children in Gaza during this war. An ancient biblical proverb offers a powerful depiction of what it would be like for us Christians to celebrate Christmas as usual. It would have felt “like one who takes away a garment on a cold day, or like vinegar poured on a wound, is one who sings songs to a heavy heart.”

However, the announcement of the cancellation issued by the head of Bethlehem municipality, was made exclusively in honour of Palestinian “martyrs”, in Gaza and the West Bank. This disappointing statement distorts the church’s role in the region as a peace builder and the bridge amongst different communities and ethnicities. In fact, it is an utterly missed opportunity for the church to demonstration its ethics and values in the region, especially when confronted with losses of lives across all ethnicities and religions. A more inclusive nuanced statement that could have honoured the suffering of all, could have been worded along the lines of offering tributes to the devastating losses of lives in the Israel-Hamas war since the 7th of October, without any discrimination or prejudice. That old proverb continues to say, “if your enemy is hungry, give him food to eat; if he is thirsty, give him water to drink.”

The exclusivity of the statement's approach made by the churches was a lost opportunity to express a more authentic side of Christianity to the world revealed from its birthplace. It could have counteracted the way the church was portrayed in Europe during the Holocaust. It could have been the chance to respond in a less indifferent manner to the plights of the Jewish people in the region, rather than reiterate a similar stance of the European churches during World War II.

A ceasefire is what Palestinian Christians will be praying for during this Christmas, alongside praying against the perpetual cycles of death, violence, and destruction, inspired by what our brothers and sisters in Gaza have conveyed to us in private communication. Christians in Gaza are pleading for peace and stating that as a community, they oppose violence. The zero-sum approach towards this war has made it difficult for us Christians to be true to our faith without being condemned or oppressed for it. When we call for a ceasefire, we are accused of supporting terrorism and denying Israel’s right to self-defence. However, when we want to acknowledge the suffering of the Israeli side during the 7th of October, we are deemed to be traitors. Our objective isn’t to attempt to prevent Israel from defending itself; rather, to suggest that the consequences of inflicting violence and bloodshed in retaliation could reinforce a stronger hold for violence and extremism in the region.

Therefore, most Palestinian Christians do not feel they have the freedom to stand for their beliefs and the churches in the region are not portraying the best paradigm. In my opinion, this is one of the main factors behind the drastic decline of the Christian population generally especially in Bethlehem. It is also why they no longer hold as much power as they used to in influencing the culture and mindsets in the area. Their roles became more politicised which has gradually led them to neglect standing up for truth until it has become too dangerous to even express it. This could well lead to a reality where this would be the last Christmas in Bethlehem for a majority of Christian families.