Recently, at a nursing leadership programme in Oxford, attendees focused on the fundamentals of care. Have we forgotten how to care? What can we re-learn from those who pioneered an ordinary yet profound act that affects millions?

Anam Cara is an old Gaelic term for ‘soul friend’, a person with whom you can share your innermost self, your mind and your heart. It is a term that Tom Hill, former chief executive at Helen House Hospice in Oxford, used to describe the relationship between his staff and the thousands of children and their families who passed through their ‘big red door’ in its first twenty-five years. The hospice (or ‘loving respice’ as it became known) had been founded by Sister Frances Dominica in 1982.

Other care in this country can also trace its religious roots. Between 1048 and 1070 in Jerusalem, the Order of St. John was founded for the purpose of helping pilgrims (“our Lords, The Sick”) who had become lost, weary, or beset by other difficulties while on their way to the Holy Land. Today, in the United Kingdom, the British Association of the Order has extended care to older people first in almshouses and later in care homes. A trustee for ten years was John Monckton, a man of ‘considerable talent, enormous integrity and deep religious conviction’; his tragic murder in 2004 led to the creation of the John Monckton Memorial Prize, which recognised and rightly celebrated commitment to care by care workers.

Today, across the world, seen and unseen, nurses, carers and families continue to provide compassionate care. “Assisting individuals, sick or well, in the performance of those activities contributing to health or its recovery (or to peaceful death) that he would perform unaided if he had the necessary strength, will or knowledge” is the very essence of nursing, captured by ‘architect of nursing’, researcher and author Virginia Henderson in 1966. Meeting more than basic needs such as breathing, eating, drinking and eliminating bodily waste (which are of essential importance), Henderson recognised the role of the nurse in enabling humans to communicate with others, worship according to their faith, satisfy curiosity and sense accomplishment.

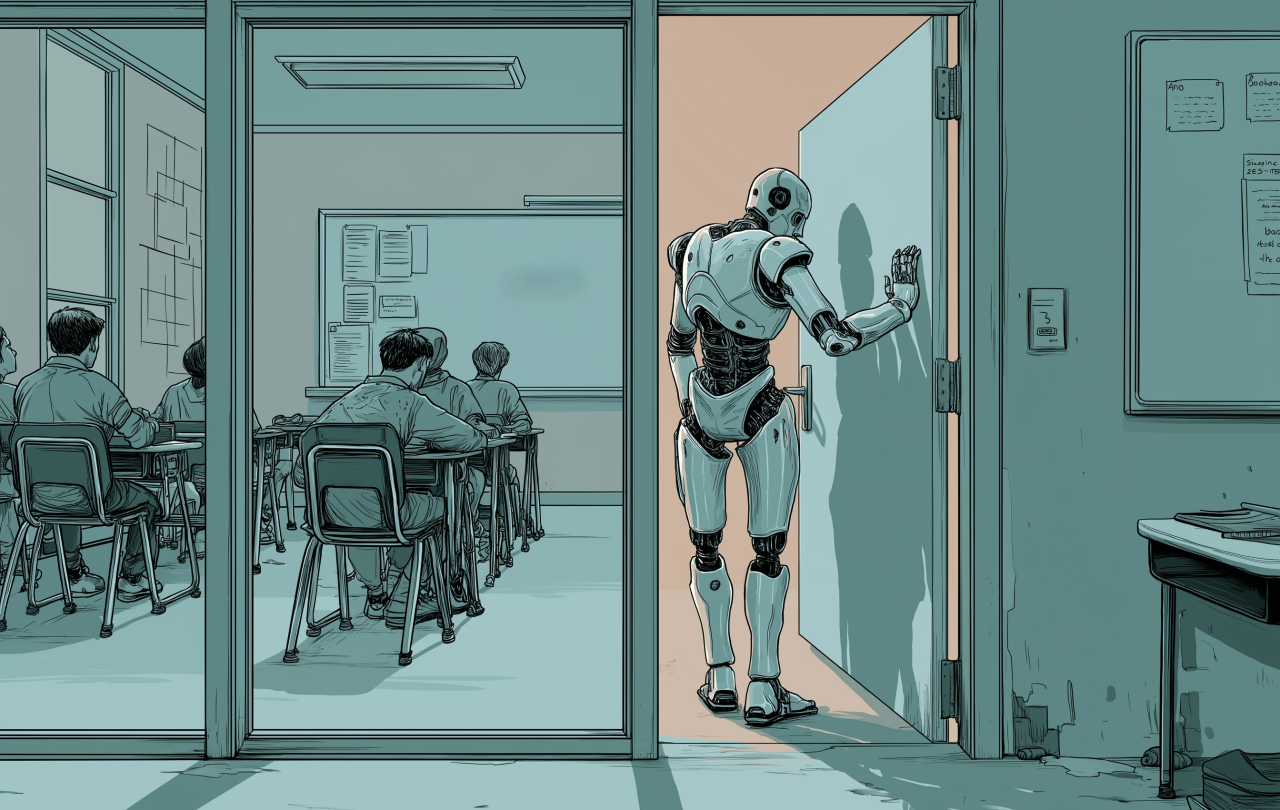

In the desire for modernisation and professionalisation, have we lost sight of the core values and activities central to patient care?

An uncomfortable truth brought out in healthcare reports such as the Final Report of the Special Commission of Inquiry (The Garling Report) 2008, and the Report of the Mid Staffordshire NHS Foundation Trust Public Inquiry (The Francis Report) 2013 is though that this type of nursing is too often done badly or even missed, leading to pressure injury, medication errors, hospital-acquired infection, falls, unplanned readmission, critical incidents and mortality. According to nurse scientist and scholar Professor Debra Jackson, “missed care occurs much more frequently than we might think”. She cites a systematic review in which ‘care left undone’ on the last shift ranged from 75 per cent in England, to 93 per cent in Germany, with an overall estimate of 88 per cent across 12 European countries’.

In one offensively-titled paper, “Shitty nursing - the new normal?” (in which the authors apologise for the title but not the questions raised), real-life pen portraits are drawn of patients lying for hours on hospital trolleys, immobile through infection or injury, ignored by staff. Whilst acknowledging contextual factors for poor care, such as a shortage of nurses and resources, the authors argue that circumstances cannot be the sole cause of missed nursing care.

A report published by the University of Adelaide, School of Nursing, has called for nurses to ‘reclaim and redefine’ the fundamentals of care. It asks whether the cause of the problem (of missed nursing care) lies “deep in the psyche of the nursing profession itself?” “Has something happened to the way modern nursing views and values caring?” it continues. “Indeed, is nursing in danger of losing its claim to care? In the desire for modernisation and professionalisation, have we lost sight of the core values and activities central to patient care? Or is this a broader social pattern where individuals are less inclined to show kindness, compassion, and care for others even if it is a necessary requirement of the job?”

Compassion, he emphasises, is more than empathy - and way "less fluffy" but much more measurable than kindness.

Writing in the British Medical Journal, Professor of critical care medicine Peter Brindley and Consultant in intensive care Matt Morgan wonder whether doctors also “too often default to high-tech and low-touch” when patients are dying – a time “when community and connection matter most”. They powerfully begin with a mother’s comment: “Humans are gardens to tend – not machines to fix.”

Professor Sir Al Aynsley-Green, the first National Clinical Director for Children in Government and former Children’s Commissioner for England, and past president of the British Medical Association, suggests that we as a society need a “momentum for compassion”. Struck by the extremes of compassion witnessed during his wife’s treatment in the last years of her life, Sir Al wants to see a cultural transformation in healthcare: for compassion to be a key operating principle in NHS and care settings, led by the Chief Nurse’s Office; for every organisation to promote the importance of compassion at the professional level; for the views of patients and families to be sought regularly; for much earlier and better focus on compassion in undergraduate and postgraduate teaching programmes for all staff; for compassion to be inspected against by the Care Quality Commission; and for a willingness to encourage staff at all levels to expose poor practice as well as celebrating excellent care.

Compassion, he emphasises, is more than empathy - and way "less fluffy" but much more measurable than kindness. “It’s putting yourself into somebody else’s shoes – and doing something about it.” Recently appointed the UK’s first Visiting Professor in Compassionate Care at Northampton University, at the age of 80, Sir Al certainly is doing something about it. He has made it his new purpose in life to “embed compassion into every aspect of care”.

Like Sir Al, Queen Elizabeth II, the UK’s longest serving monarch, espoused compassion, in word and deed. Living a life of compassionate service, the Queen made clear that her Christian faith was her guiding principle. She speaks of Jesus Christ as ‘an inspiration,’ a ‘role model’ and ‘an anchor’. “Many will have been inspired by Jesus’ simple but powerful teaching,” she said in her Christmas Broadcast, 2000. “Love God and love thy neighbour as thyself – in other words, treat others as you would like them to treat you. His great emphasis was to give spirituality a practical purpose.”

When nurses do unto others as they would have done unto themselves, and act as role model to colleagues, not only do patient experiences of care and their outcomes improve – but so does job satisfaction for nurses: a critical factor in nurse recruitment and retention – the biggest workforce challenge faced by healthcare organisations. Across the UK, there are currently more than 40,000 nursing vacancies, and thousands of burnt-out nurses are leaving the profession early. Whether nurses decide to stay or go is driven in part by their daily experience at work. The late Kate Granger, Consultant in medicine for older people, inspired Compassionate Care Awards in her name, envisioning that such a legacy would drive up standards in care - and surely also help retain nurses, through restoring a sense of pride, achievement and fulfilment to the nursing workforce.